Overview

Action Items

- Review new requirements for Illinois non-competition and non-solicitation agreements that take effect on January 1, 2022.

- Evaluate the impact on your Company’s practices, such as extent of usage, compensation levels, hiring timelines, onboarding documents, and recordkeeping.

- Assess alternatives for protecting legitimate business interests, such as internal safeguards for confidential information, employee departure procedures, and increased scrutiny of external candidates.

- Consult with legal advisors about compliance and document review.

At the close of the recent legislative session on May 31, 2021, Illinois legislators passed Senate Bill 672, which contains significant new restrictions on the use of non-competition and non-solicitation agreements in Illinois. It is expected that Governor Pritzker will sign this legislation in a matter of weeks.

Non-competition and non-solicitation agreements are a common, key method of protecting a company’s legitimate business interests upon an employee’s departure. Illinois has not gone so far as some other states in declaring these wholly unenforceable, but newly adopted amendments to the Illinois Freedom to Work Act continue a recent trend of stiffening requirements and curtailing use.

Below are the highlights of the legislation:

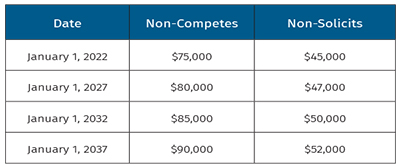

- Minimum Annual Earnings. A non-competition restriction or a non-solicitation restriction for employees and/or customers entered into on or after January 1, 2022 is void and unenforceable against an employee whose actual or expected annualized earnings are less than specified thresholds. As set forth below, these thresholds will gradually increase every five years until 2037. Earnings include salary, bonuses, commissions, and any other form of taxable compensation reported on a Form W-2 (including amounts attributable to elective deferrals).

Note that these compensation-based restrictions are in addition to an existing ban on non-competition restrictions for employees earning the legal minimum wage or less than $13.00 per hour (whichever is greater).

- Consideration Period; Attorney Review. Employees must be given a copy of the restrictions at least 14 days prior to the start of employment, or otherwise must be provided at least 14 days to review and consider them. Employees may voluntarily sign prior to the expiration of this period. Additionally, prior to signing, employees must be advised in writing of their right to seek legal counsel.

- Recovery of Employee Attorneys’ Fees; Fee Shifting. Employees who prevail in litigation or arbitration involving the enforceability of a non-competition or non-solicitation restriction will now be entitled to recover their reasonable attorneys’ fees, irrespective of whether the agreement provides for such recovery. This potential financial risk will need to be considered when determining whether a non-competition or non-solicitation restriction is necessary to protect a company’s legitimate business interests.

- “Blue Penciling.” Illinois courts have long had the discretion to narrow overbroad restrictions and permit enforcement on a narrower basis than as drafted, in lieu of refusing to enforce the restrictions entirely. The law codifies this so-called “blue pencil doctrine,” but it also makes clear that the doctrine is optional. Courts will be required to consider a range of specific factors, including the fairness of the restriction as drafted, and whether it was drafted in good faith to protect legitimate business interests (such as keeping confidential proprietary information and trade secrets, or protecting valuable customer and employee relationships). All companies will need to review their current forms for necessary “blue pencil” language and also for preliminary reasonableness, which may ultimately impact the availability of this last-resort doctrine.

- Existing Agreements. Because these new requirements apply to agreements entered into on or after January 1, 2022, impact on existing agreements will likely be minimal. However, the requirements could apply to existing agreements if they are amended on or after that date. In addition, while not expressly stated in the legislation, Illinois courts may find, beginning on January 1, 2022, that the fee-shifting remedy is available in any litigation or arbitration involving a restriction – irrespective of when the litigation commenced and when the restriction was signed.

- Exclusions. Generally, these requirements do not apply to agreements or provisions that govern only confidentiality, nondisclosure, invention assignment, or other proprietary rights, as well as covenants entered into in connection with the sale of a business. Nevertheless, relevant circumstances or specific phrasing of a particular provision may overcome this general rule.

- Enforcement Based on At-Will Employment. Under Illinois law, employees must receive something of value—“consideration,” in legal terms—to support the enforceability of non-competition and non-solicitation restrictions. Adequate consideration may be any number of things, from a cash signing bonus to employment itself. A 2013 Illinois Appellate Court decision, Fifield v. Premier Dealer Services, Inc., 2013 IL App. (1st) 120327, created uncertainty about whether and when at-will employment is sufficient consideration if no other benefit is provided. The new law clarifies that a continuous period of at-will employment for at least two years is adequate consideration under law. An amount of “professional or financial benefits” may also be adequate consideration, whether or not in combination with a lesser period of at-will employment, but no bright-line rule will apply short of two years.

- COVID-19 Terminations. Although a novel issue, the law voids and makes unenforceable non-competition and non-solicitation restrictions entered into by an employee who was or is furloughed, terminated, or laid off due to business circumstances or governmental orders related to COVID-19 (and similar circumstances), unless the employee is paid base salary from the termination date through the conclusion of the restricted period (less the amount of compensation, if any, earned from subsequent employment during the restricted period). Because the statutory language is indefinite—“circumstances similar to the COVID-19 pandemic”—it may be prudent for companies to consult with legal counsel whenever post-employment enforcement is particularly critical and severance benefits are less than the employee’s salary for the applicable period.

We Can Help You

Barack Ferrazzano’s Compensation & Employment and Commercial Competition Groups have decades of experience in counseling companies and litigating disputes about restrictive covenants and employee competition matters, as well as helping companies navigate the maze of employment law compliance. Please contact us if you would like to discuss specific questions about your restrictive covenants or review of your agreements and practices, or if we can otherwise be of assistance.